Why the FTC Investigated PBMs and What it Means for You

ACMA

Jul 9, 2024

5 minutes read

Pharmacy Benefit Managers (PBMs) are “middlemen” that negotiate the terms and conditions for access to prescription drugs. Critics share that these organizations hold enormous power and influence over patients’ access to drugs and the prices they pay. The nation’s leading PBMs frequently have the ability to exert control on the pharmacies patients can go to to obtain prescriptions. This affects many Americans and their willingness to take prescriptions. According to the American Medical Association (AMA), prior authorizations are the number one reason for care delay in the United States. With an increasingly greater number of specialty drugs in the pipeline for regulatory approval, we can expect prior authorizations to create even more obstacles. PBM policies have made it challenging for healthcare providers (HCPs) to navigate these administrative obstacles.

PBMs also have powerful influences over independent pharmacies. These types of pharmacies are privately-owned (read: not owned or operated by a publicly traded company or PBM) businesses that deliver a different level of personalized care and service to patients. These are especially seen most in rural areas where access to care is limited. Between 2013 and 2022, about 10% of rural independent retail pharmacies closed. Causes of these closure are attributed to their struggle to navigate contractual terms imposed by PBMs, which are at times confusing, unfair, arbitrary and harmful to the pharmacies’ businesses.

FTC Conducts Investigation into PBMs

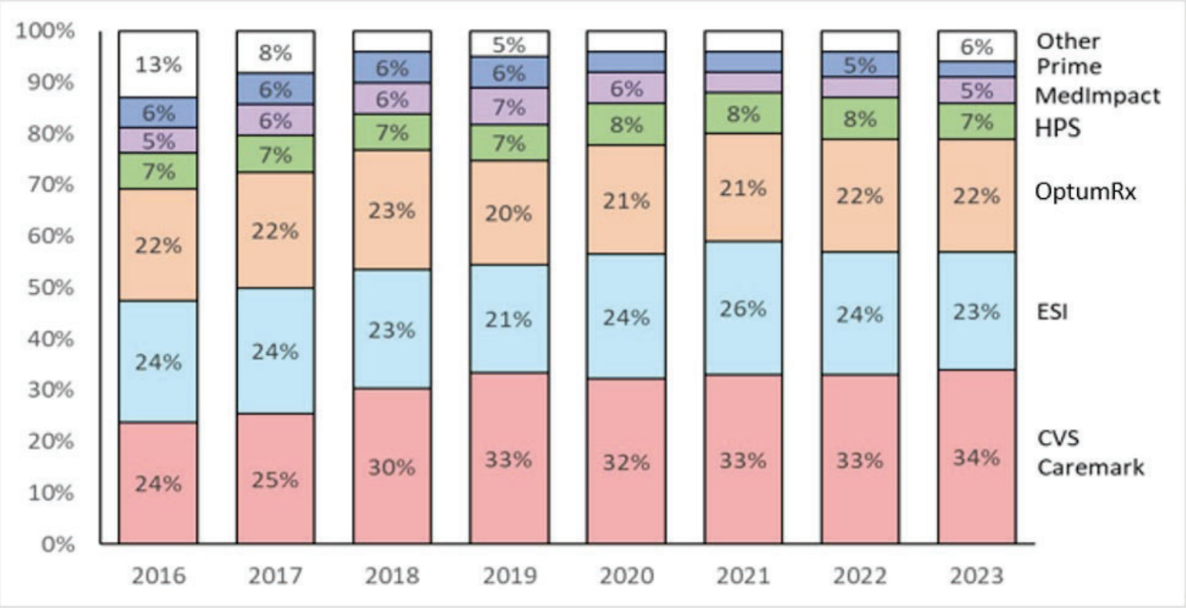

Because PBM practices lack transparency and accountability to the public, in 2022, the Federal Trade Commission (FTC) requested data and documents of business practices to the six largest PBMs: Caremark Rx, LLC, Express Scripts, Inc., OptumRx, Inc., Humana Pharmacy Solutions, Inc., Prime Therapeutics LLC, and MedImpact Healthcare Systems, Inc. In May and June 2023, the FTC ordered additional data to three additional PBM entities. The 6 companies mentioned above together control 94% of all U.S. drug prescriptions. The top three PBMs processed nearly 80 percent of the approximately 6.6 billion prescriptions dispensed by U.S. pharmacies in 2023. The combined companies are enormous “conglomerates that can exercise vast control over huge swaths of the healthcare sector.” The diagram below shows the dominance of large PBMs throughout the years.

Given the current state of PBM dominance, pharmacists, health insurers, and drug manufacturers often have little choice but to interact with the large, dominant PBMs when distributing certain drugs.

July 2024: FTC Releases Report of Findings – PBM’s Impact on Patient Access

The FTC report released in July 2024 found that the investigation’s initial conclusions “urgently warranted further scrutiny and potential regulation.” PBMs are criticized for raising drug prices among a competition that should lower prices, and for decreasing access to drugs when competition should make access increase. The findings of the report that contributed to this conclusion include:

Lack of Cooperation from PBMs

- The FTC emphasized repeatedly that it struggled to obtain information from uncooperative PBMs. Particularly in the part of the investigation looking into how the companies work with drugmakers, the FTC might go to court to compel PBMs.

- Because PBMs have the incentive and ability to steer a growing share of prescription revenues to their own pharmacies, it may be unfair for the smaller pharmacies. This is one main reason that justifies the FTC to constrain PBM’s practices.

PBM Revenue Generation Tactics

- PBMs obtain more revenue through specialty drug classification, self-preferential pricing, and pharmacy contracting procedures to target and control the business operations of pharmacies.

- PBMs are creating group purchasing organizations (GPOs) to manage the relationship with pharma companies, particularly for negotiating rebates on drugs. These GPOs have successfully collected increasing fees from drugmakers. This again demonstrates PBM’s desire for revenue.

Anticompetitive Practices

- The report discussed vertically integrated market power, where a parent insurance company or specialty retail pharmacy uses its own PBM to choose a pharmacy network, then asks patients to use its own pharmacies at the exclusion of competitors.

- PBMs may also use narrow networks to channel patients into their own affiliated pharmacies, even if competitors offer drugs at the same prices.PBMs actions may harm competition in the market, such as by diminishing small independent pharmacies. And this could lead to higher costs and lower quality of care to patients.

Challenges for Independent Pharmacies

- Independent pharmacies typically do not have the bargaining power to negotiate terms and rates when joining PBM’s pharmacy networks, leading to potential one-sided changes in contract terms without viable alternatives.

- The rise of intricate and unclear contract terms and adjustments has heightened uncertainty in pharmacy reimbursements, posing challenges for smaller pharmacies in running their day-to-day operations. In many cases, the rates outlined in PBM contracts with independent pharmacies do not transparently indicate the actual payment the pharmacy will receive.

Drug Utilization & Prior Authorizations

- PBMs and brand pharmaceutical manufacturers occasionally make deals to omit generic drug and biosimilars from specific formulaires in return for increased rebates from the manufacturer. These exclusive rebates could restrict patient access to more affordable medications and should be subject to additional examination by the Commission, policymakers, and industry stakeholders.

- PBM’s Drug Utilization Management services has the ability to implement and enforce regulations on prior authorization, step therapy, and quantity restrictions. And evidence has shown that PBMs sometimes agree to require prior authorizations and step therapy to discourage patients’ use of generic drugs

Upskilling in the PBM-Dominated Healthcare Space

PBMs often impose complex prior authorization (PA) requirements as part of their practices to maintain control over the healthcare system. The FTC report highlights how these PBM conglomerates can exercise vast power, including the ability to influence which drugs are covered by insurers and how much patients pay out of pocket.

Prior authorizations serve as an additional roadblock that PBMs use to restrict access to certain medications. By requiring healthcare providers to obtain approval before specific drugs can be filled, PBMs can steer patients towards medications that are more profitable for the PBM or its affiliated entities. This adds administrative burden and delays on both providers and patients, limiting access to needed treatments.

Given the FTC’s findings on the anticompetitive practices of PBMs, individuals working on prior authorizations must proactively upskill. Certification in these areas, including in the prior auth process, will equip PA staff with a deeper understanding of the evolving prior authorization requirements and processes imposed by dominant PBMs. Many Prior Authorization Certified Specialists (PACS) are able to navigate the increasing complexity and serve as advocates for patients, ensuring timely access to appropriate medications despite the roadblocks erected by these powerful PBM conglomerates. By becoming certified experts in prior authorizations, these professionals can adapt to the changes stemming from potential regulatory actions and continue providing high-quality, patient-centered care.

References

Armstrong D. FTC says PBMs “exercise vast control” over healthcare, but stops short of calling for antitrust action. Endpoints News. July 9, 2024. https://endpts.com/ftc-says-pbms-exercise-vast-control-over-healthcare-in-long-awaited-report-on-drug-middlemen/

Liu H, Staff in the Office of Technology. Pharmacy Benefits Managers (PBM). Federal Trade Commission. May 23, 2024. https://www.ftc.gov/terms/pharmacy-benefits-managers-pbm

Become excellent in prior authorization, reimbursement & market access: Become a prior authorization certified specialist

PACS Links

What is PACS?

PACS reviews

Why certify?

PACS price

PACS recertification

PACS extension

PACS FAQs

Quick contact

info@acmainfo.org